YEG REAL ESTATE RESULTS JANUARY 2024 – JFSELLS.COM

Posted by John Fraser on

YEG REAL ESTATE RESULTS JANUARY 2024 – JFSELLS.COM

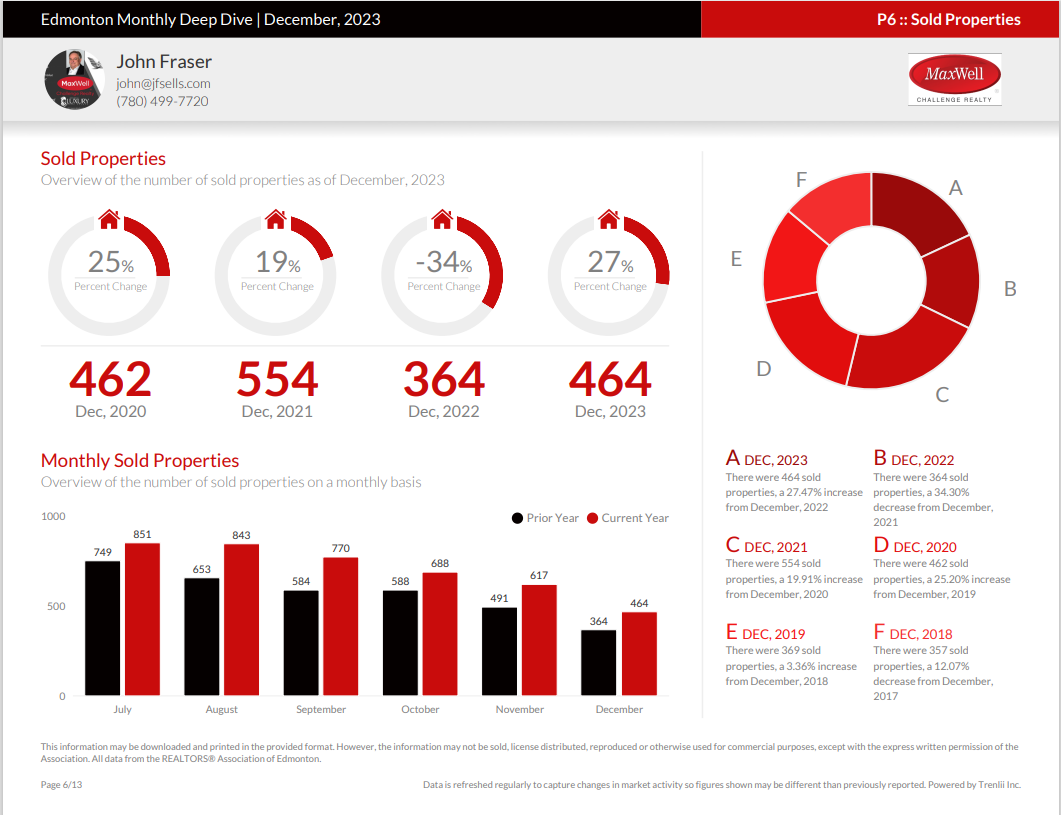

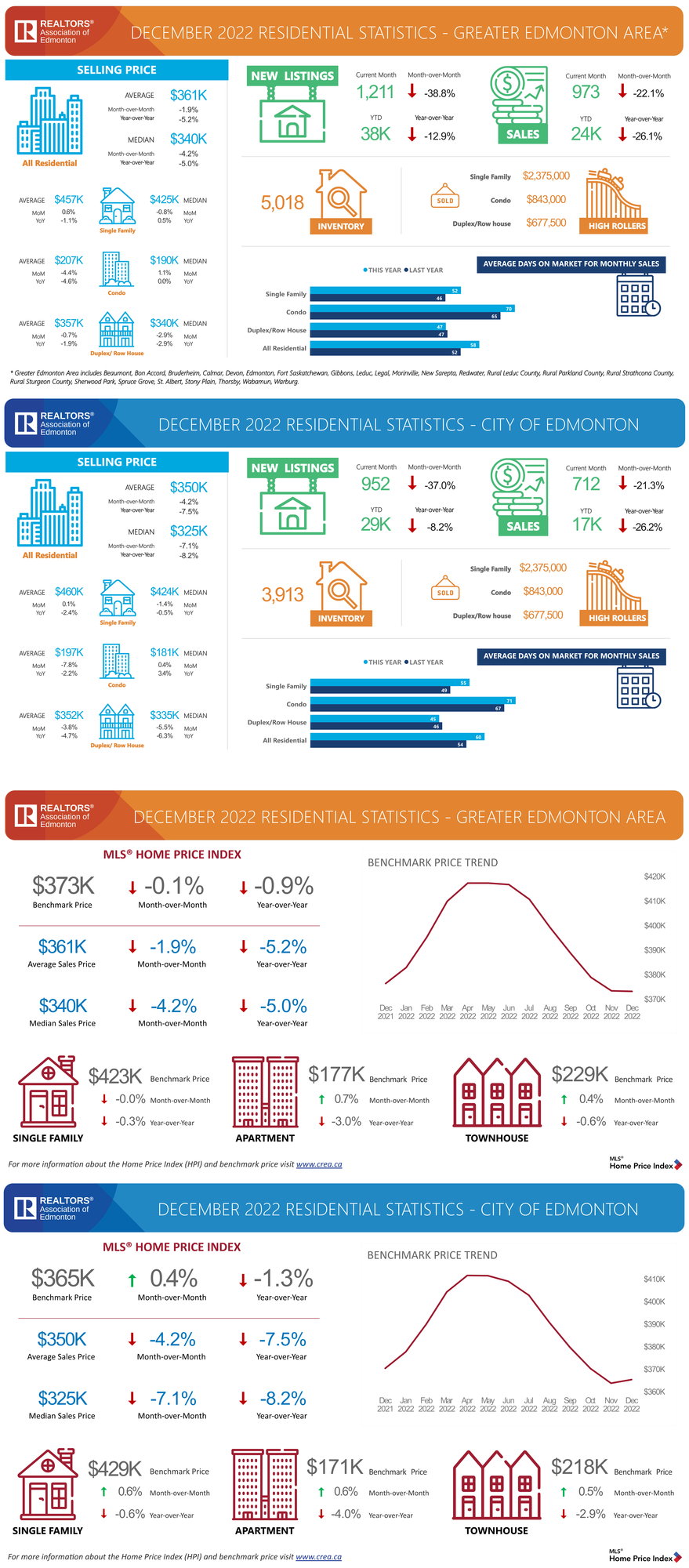

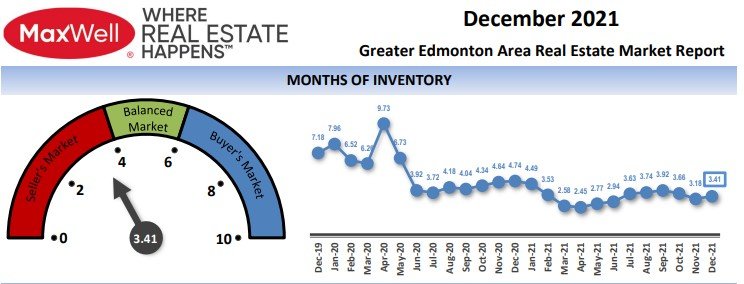

January has started strong for Edmonton and Area! Many Stats and Prices are up. Demand appears to be out pacing supply on the residential side in several segments. See it all here;

Slow And Steady Numbers a Good Sign for 2024 RAE Market Summary

JANUARY_2024_CREA-EDMOStats for full stats package

JANUARY_2024_MonthlyStatsBoard for full visuals

TN Commercial__2023 Year-End Edmonton Report. For 2023 Full Year Commercial Review

2024-01_Edmonton_Statistics MaxWell Realty 24 Month Historical

99 Views, 0 Comments