INVESTMENT PROPERTY ROI, SECONDARY SUITES AND MORE: DIRT GOES UP IN VALUE… BUILDINGS GO DOWN

2024 Update: Drop me a line to learn more about How Edmonton’s New Zoning will effect all of this

Land vs Building Impact on ROI long term Equity (Pdf download)

When investing in real estate, there are many factors to consider when defining your goals & strategy.

When it comes to rentals, 3 factors that have impact on your mid to long term equity and your short term/Cash flow are: Rent (income); Purchase price plus improvements & maintenance (cost); Appreciating & depreciating assets (equity). The latter’s impact is sometimes underestimated.

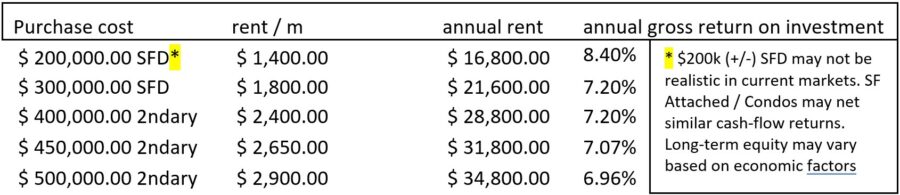

The “ballpark” scenarios here intend to illustrate the potential impact of rent value vs equity factors:

In the current market a nice reasonably appointed 1000-1100 ft bungalow ($350k) in an “ok” area may get $1800-2000/m; One for $275k-325k may rent for $16-1800/m. I know firsthand of examples valued at $300-350k getting $2000/m plus utilities for the past 5 years & right now.

Many favor a rental with a legal 2ndary suite (valued at $400-500k), netting $24-2600/m as a good return / better investment vs. the “single family bungalow”. Thought being: There is higher potential for income with diversification.

There are a ton of factors that drive the risks/rewards that should be considered when deciding for yourself (including the effort to rent to 2 groups vs 1 for effectively the same ROI at a higher cost).

Be it Single Family or 2ndary; What the cost & rent will be are critical, but what does that look like?

See Excel here for following 2 tables:

Is the 2ndary suite really a better option? More work to rent to 2 parties, potential for higher turnover & all the work that comes with prepping to re-rent vs diversification… your call; it’s all about info!

Now for the impact of what appreciates vs depreciates on your investment:

Dirt goes up in value – buildings go down… (at least without reinvestment/force majeure /economic impact)

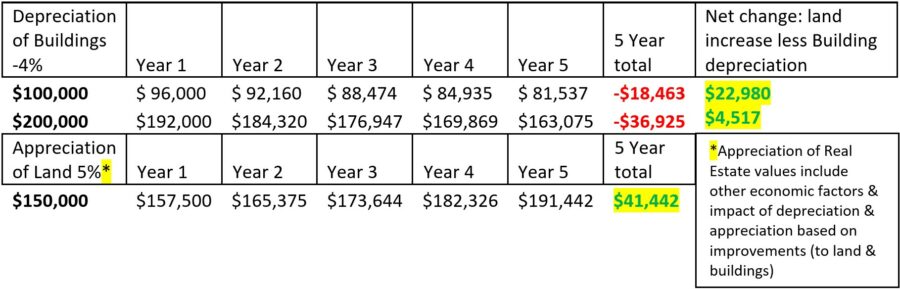

2 examples (download paper here) using same land value & 1 home value $100k, the other $200k. Accepting CRA’s deprecation for this is 4% / year (a modest measurement) & that long term historical real estate returns are 5%(+/-):

This factor can literally make or break your longer term results. That said; When considering your specific situation – consult your accountant & tax consultant. For some, a higher depreciation value may bode well for the long term / at time of disposition depending on your overall financial situation. Of course all of it is subject to market trends during the time frame owned.

This factor can literally make or break your longer term results. That said; When considering your specific situation – consult your accountant & tax consultant. For some, a higher depreciation value may bode well for the long term / at time of disposition depending on your overall financial situation. Of course all of it is subject to market trends during the time frame owned.

Applications:

With a budget of $500k: If you buy 2 houses at $250k each & rent for $1600/m you may better your ROI via improved income, occupancy rate & equity growth.

Buy 1 for $250k & reno (if your handy/have access to super cheap support) using DIY options, spend $50k to a total of $300 invested with a closer to $75+k impact). Rent for 2000/m to get an 8% annual return & Find your diversification from a lower cost condo / other (after maxing your RRPS etc)

Buy 2 at $200k each & rent for $14-1500. You may get the best of Annual Income & Equity too.

There are many paths to “ROI” & more choices exist in both single & multifamily home markets.

It’s a game of inches that may make miles in the long run. FOR SOME, MULTIFAMILY COMMERCIAL offers alternatives- #askme for details anytime!

Beyond the obvious sage wisdom like: keeping total cost / purchase $ low & a focus on marketability of the property (rent for more based on location & features):

High land to building value ratios are a prudent bellwether. Caveat – some may prefer alternate ratios based on their goals / income / tax positions (i.e. cash now vs equity later, cap gains etc.) but many want best of both.

What’s most important? You make informed decisions for what’s best for you based on your goals, needs, risk tolerance, time, effort & skillset. Get as much info from reputable sources as possible when forming your plans right through to the execution of all actions.

Contact me any time to discuss!

John J Fraser

REALTOR®

Cell: 7804997720

Office: 7804834848

Maxwell Challenge Realty

www.jfsells.com | www.johnjfraser.com

Email: JohnFraser@MaxWellRealty.ca

facebook.com/edmontonrealtypro

Want the most accurate, up-to-date MLS information? It features augmented reality search, large photos, advanced search filters & more.

Download it here, or Text JFSELLS to (587)-414-0147!

Leave A Comment